As you may know, the Blyth Fund’s fiscal year ends in April. It will soon come time for the Fund’s annual leadership transition that occurs at the start of Spring quarter. This past weekend, Fund’s Board of Directors met to select a new Executive Team for the coming fiscal year in preparation for that time. We are excited to announce the Fund’s new leadership.

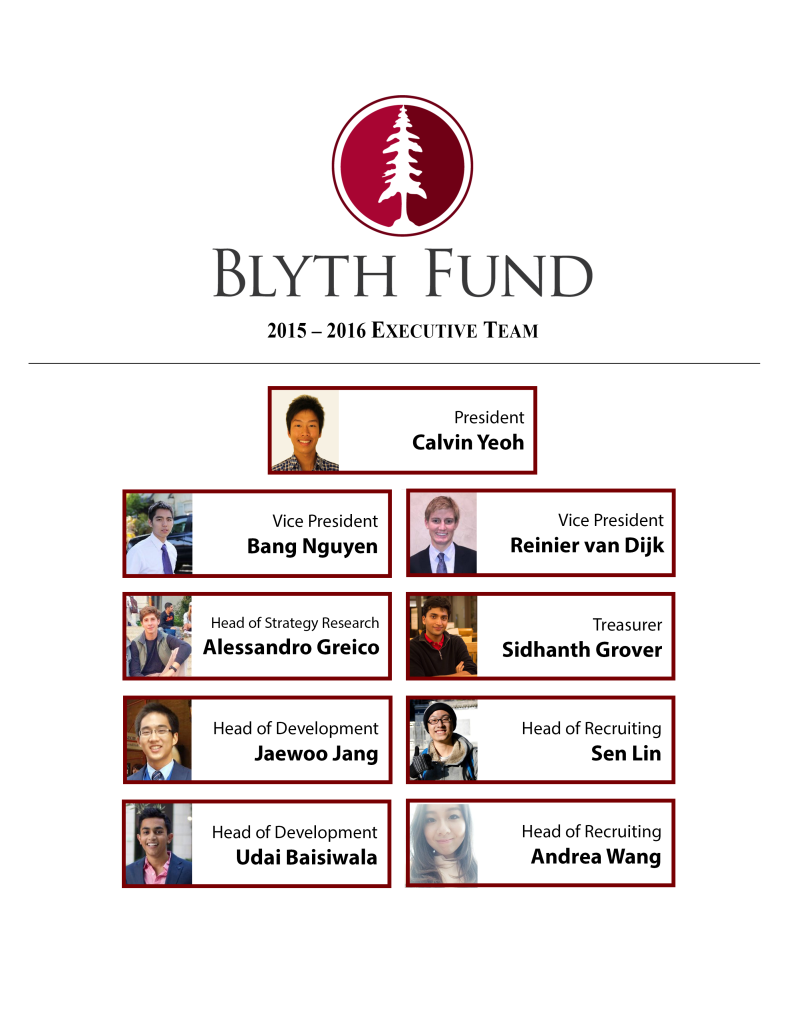

Calvin Yeoh, who as the current Vice-President of the Fund has been instrumental in leading it this past fiscal year, will take over as President. He will be aided by Vice Presidents Bang Nguyen and Reinier Theodorus Eenkema van Dijk, both of whom currently lead Coverage Groups within the Fund. Alessandro Greico, who also currently leads a Coverage Group, will take over as the Fund’s Head of Strategy Research. Udai Baisiwala and Jaewoo Jang will take over the Fund’s educational programs as its Heads of Development. Sen Lin and Andrea Wang will bring their substantial prior experience in recruiting roles to help the Fund grow even further next Fall. Lastly, Sid Grover will assume the role of the Fund’s Treasurer, bringing his past accounting and financial experience to managing the Fund’s books.

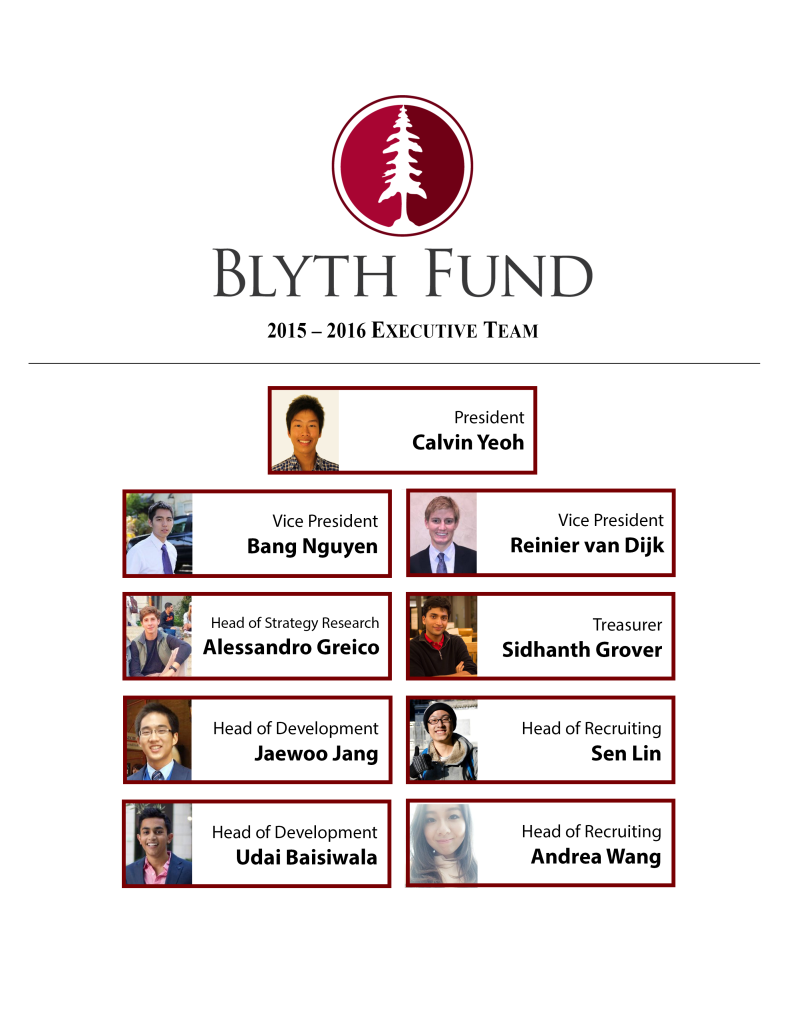

In summary, the full 2015-2016 Executive Team is shown below:

Note that because Calvin is going abroad to Oxford this Spring, Bang and Reinier will manage the majority of the Fund’s day-to-day operations in his absence. Calvin will resume full responsibility of day-to-day operations when he returns in the Fall.

Congratulations to the Fund’s new Executive Team, and we are excited to say that the Fund will be in great hands going forward. We feel completely confident that Calvin and the new Executive Team will do a tremendous job.

Sincerely,

The 2014 – 2015 Blyth Fund Board of Directors