Basic Quantitative Analysis for Marketing

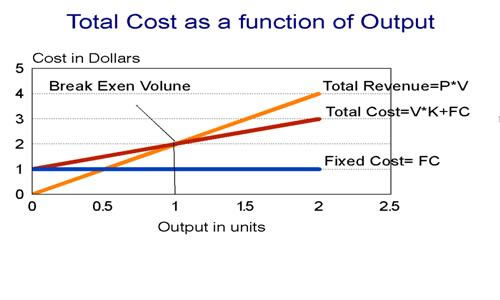

Simple calculations often help in making quality marketing decisions. One of the most useful quantities is calculating break-even volumes, i.e., the quantity of units which must be sold to recover an initial investment. With this number we can then ask how long will it take to sell this many units and is it reasonable to assume that the market overall is big enough to support this volume. When sales exceed the break-even volume, the firm starts making a profit.

Unit Price (P) = price of one unit

Variable cost (K) = cost uniquely associated with each unit produced (example, Microprocessor on a PC mother board)

Fixed cost (FC) = cost which are fixed and do not vary with the volume of output (example, a new IC fab plant)

Contribution (C) = the difference between the price (P) of one unit - Variable cost per unit (K) C=P-K

Volume (V) = quantity of units produced

Break-even volume (BEV) = $ Fixed Cost FC/C ($ contribution per unit)

Example

Intel Itanium chip has a unit sale price of $250. Variable manufacturing cost is $15. Cumulative investment by Intel to develop the Itanium and convert over a fab facility is $1B

Unit Price (P) = $250

Variable cost (K) = $15

Fixed cost (FC) = $1B

Contribution (C) = $250 - $15 = $235/unit

Break-even volume (BEV) = = $1B / $235= 4,255,319 units = 4.3M units

Analysis

- Is it reasonable to assume that the market overall for the Itanium is big enough to support this break-even volume, i.e., the quantity of units which must be sold to recover an initial investment.

- How long will it take Intel to sell this many units and start making a profit?