FP-KatPhan-BrandonLiu-ChristineQuan

Contents

Visualizing Crunchbase

Proposal

Group Members

- Brandon Liu

- Christine Quan

- Kat Phan

Description

Motivation

For an individual user, there is currently no optimal way to systematically view venture capital and startup data to gain real insights. Crunchbase.com provides unique information about existing startups and venture capital firms but the UI lacks an organizational framework for visualizing the data; the majority of its information is consolidated in news reports and raw data listings of fundraising amounts and rounds. Crunchbase’s motto is “Discover innovative companies and the people behind them,” but the site does not provide a real mechanism for identifying new targets besides a displayed series of featured investments and a search bar with filtering types. The search results displayed just feature company names and descriptions; there is no clear way to properly filter and visualize actual data results.

Project

In this project, we propose several visualizations of the current venture capitalism and startup landscape, which include (but are not restricted to): market data consolidation, Crunchbase.com company timeline revamps, and graphs of valuations, funding rounds and projections. We also propose graphical displays of VC firm and partner investment activity.

Technology

Progress Report

Progress Report Presentation

Literature Review

Prior Work

1) Visual.ly The Startup Universe

Pros: The Startup Universe is a visual guide that offers an extensive look into the connections between startups, founders and venture capitalists. Users can easily filter by the name of of the VCs, startup, and founders. Users can also modify zoom level on the timeline of specific startups to focus on a specific period and view startups, which are visually sized according to the amount of financing they have raised, with each individual round displayed as well. From this visualization, users can explore multiple tangential stories between various VCs, founders, and startups, such as how many startups has a VC company funded, whether there any trends or patterns, and whether the same person has founded multiple startups.

Cons: Users cannot filter their search based on industry or any larger category when beginning their search, meaning that they will have to begin their search with a specific VC, startup, or founder. This may lead to some industry trends being ignored and a longer search process, as the user will have to explore multiple storylines to grasp an understanding of funding histories. Furthermore, users may not be able to accurately visualize funding rounds through the concentric circle displays.

Takeaway: Using CrunchBase data, The Startup Universe provides interesting information about specific companies and the investors that made up their funding rounds, but the visualization leaves a lot to be desired. Obtaining actual insights is limited because the view frames either have too many variables or do not provide adequate filtering. A visualization should avoid cluttering and providing too many categories (Startup Universe had 19 different-colored industries that were impossible to distinguish when looking at specific data points). Additionally, it is important that users be able to easily side-by-side compare data points.

2) Pitchbook Pitchbook Pros: Pitchbook, a M&A, PE, and VC database and visualization platform, allows users to track global venture activity, monitor other startups’ and VC’s focus, portfolio, as well as sourcing and valuation activity. Pitchbook also allows users to search and filter through the database of startup companies using signals like valuation, growth, market traction, and financing history. It also offers insight into any LP’s mandate, target and actual allocations, commitments, and investment preferences.

Cons: Pitchbook is not free for use to the general public--the service charges a premium for those who want to use its services. Furthermore, the information that is gathered from Pitchbook is protected and not disclosed to the public. Takeaway: Startups may not necessarily have the bandwidth or funds to purchase such a service prior to receiving funding, so the value is lost on them. The multi-graph dashboards are interesting, however, and could provide useful information.

3) Angellist Visualizations Angellist is a website and platform for startups, angel investors, and job-seekers looking to work at startups.

Pros: Users can view in a linear activity feed the employment status of all employees at a startup, as well as investors, customers, and board members. Users can also view the amount raised per series, and the leading investors in the round.

Cons: The information about each series of funding is extracted from different sources (for example, information about the startup Medium comes from both Techcrunch.com or Crunchbase.com, but not both). There is no indicator of most recent investments (and the most recent investors), only a list of investors from all previous funding rounds.

Takeaway: Angellist lacks the detail in a lot of information and also does not provide distinct visualizations or options to switch between different levels of granularity to identify more general insights about startups, highlighting once again the importance of providing users with a mechanism to discover more general insights.

Pros: Users can view consolidated profiles about investment rounds by start-ups, venture capital firms, and funds/incubators. These profiles feature a tabular view of funding rounds (by series), investors, investments, team, recent news, and social media mentions.

Cons: The information in these profiles is presented in a very text-heavy tabular format. While fairly complete, this is not conducive to generating quick insights and understanding of investment activity for start-ups, venture firms, or incubators. Takeaway: CrunchBase provides a great repository for accessing startup data but the tabular view for funding information, investments, etc is impossible to gain systematic insights from. However, the actual information provides great inspiration for useful visualization features. For example, the timeline provides an idea for a useful view in company-specific data.

5) Dynamic Querying

http://hcil2.cs.umd.edu/trs/91-11/91-11.html (Periodic Table)

http://hcil2.cs.umd.edu/trs/92-01/92-01.html (HomeFinder)

http://hcil2.cs.umd.edu/trs/93-21/93-21.html (Cancer Map)

6) Tufte

Stacked Bars

Small Multiples

Data Ink

Clutter

Contribution from our work

Our project focuses on offering the user (startup founders) more filtering options. Though we appreciate the comprehensive view provided by visualizations such as The Startup Universe, we admit that current accessible industry models do not provide an aggregated view, or filtered views based on series, valuation, amount raised, and age of startup--all of which are provided in our new view.

Furthermore, we want our system to display the connections between investors and startups in a more streamlined timeline, so that users can view the most relevant and recent funding rounds. By combining the successful aspects of previous publically available models, we hope to create a visualization system that allows startup founders to extract, in one glance, the most pertinent information for their fundraising efforts.

Project Milestone

1. Build HTML/CSS skeleton, position buttons and interface

2. Construct the VC and startup graph view

3. Create connections between VCs and startups when user hovers over a startup

4. Build pop-out menu with specific company information when user clicks on startup

5. Search functionality

6. Filter by industry / sector

7. Build filter menu for specific startup qualities

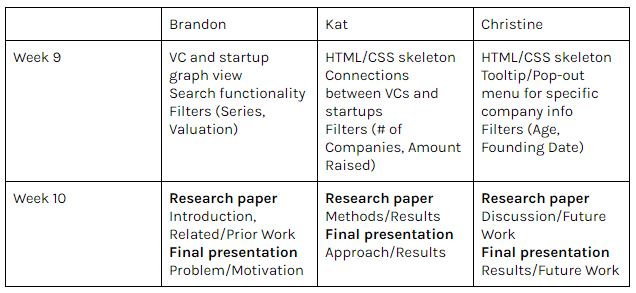

Individual Contributions (Projected)

Final Deliverables

- Final Poster

- [ventureviz.herokuapp.com/ Live Visualization]

- Source Code

- Final Paper