Relevant Charts and Figures - 2017 Pension Data

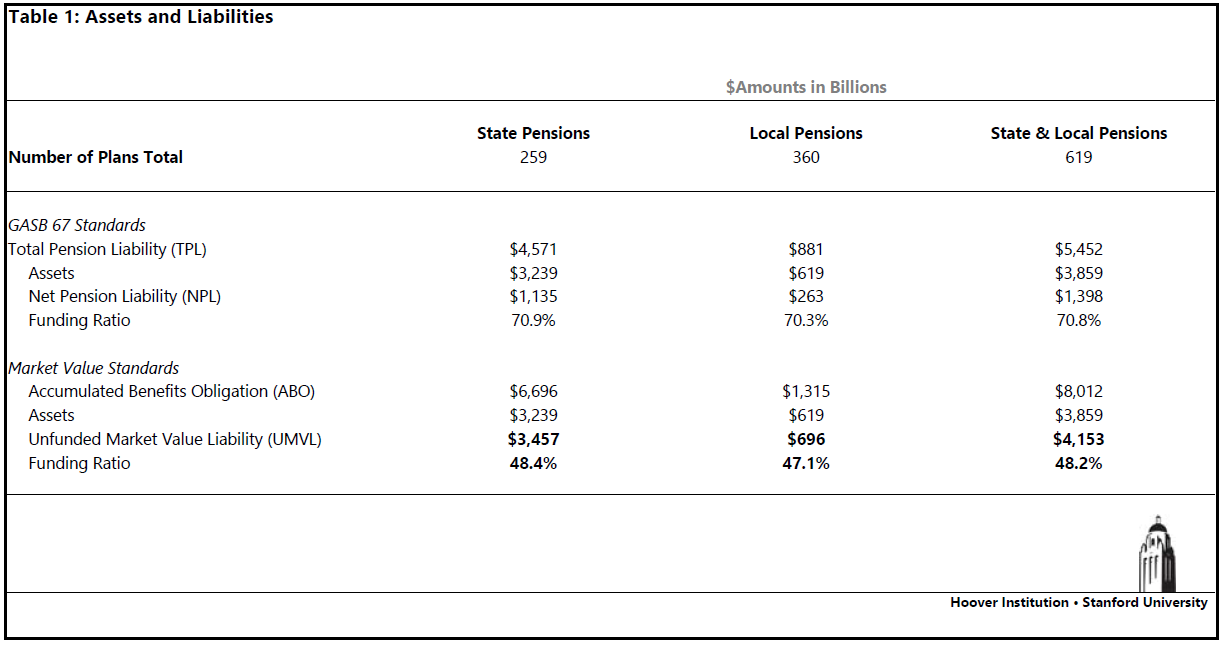

Table 1: Assets and Liabilities

Table 1 shows the summary totals for all pension systems in the United States covered in this study. The total pension liability under GASB 67 standards for all state and local funds is $5.242 trillion, which is covered by $3.859 trillion in assets, which implies an unfunded liability of $1.733 trillion and a funding ratio of 73.6%. These figures assume a liability-weighted average discount rate of 7.36% (see table 2). However, under market value standards, the total ABO (accumulated benefit obligation) liability is $8,012. Compared to the $3.859 trillion in assets, this implies a true unfunded market value liability of $4,153 and a funding ratio of only 48.2%. These figures assume an average liability-weighted Treasury discount rate of 2.77% (see Table 2).

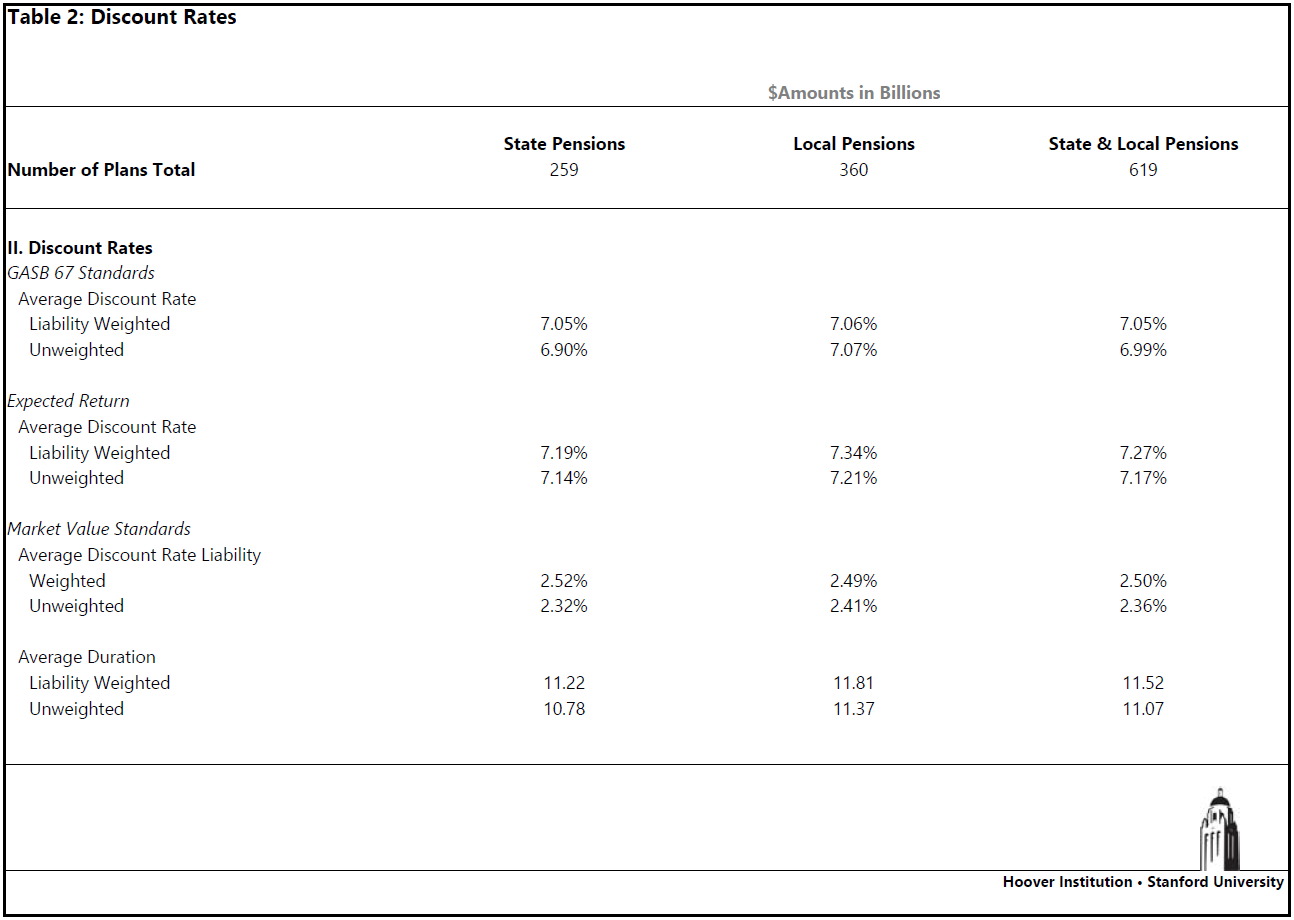

Table 2: Discount Rates

Table 2 shows the discount rates used above in Table 1 as well as the differences between GASB 67 Standards discount rates, expected return discount rates (as were laid out in each pension system’s actuarial report), and finally the market value standard discount rates. This includes both the liability weighted and unweighted rates. Finally, the table also shows the calcuated average durations using both liability weighted and unweighted rates.

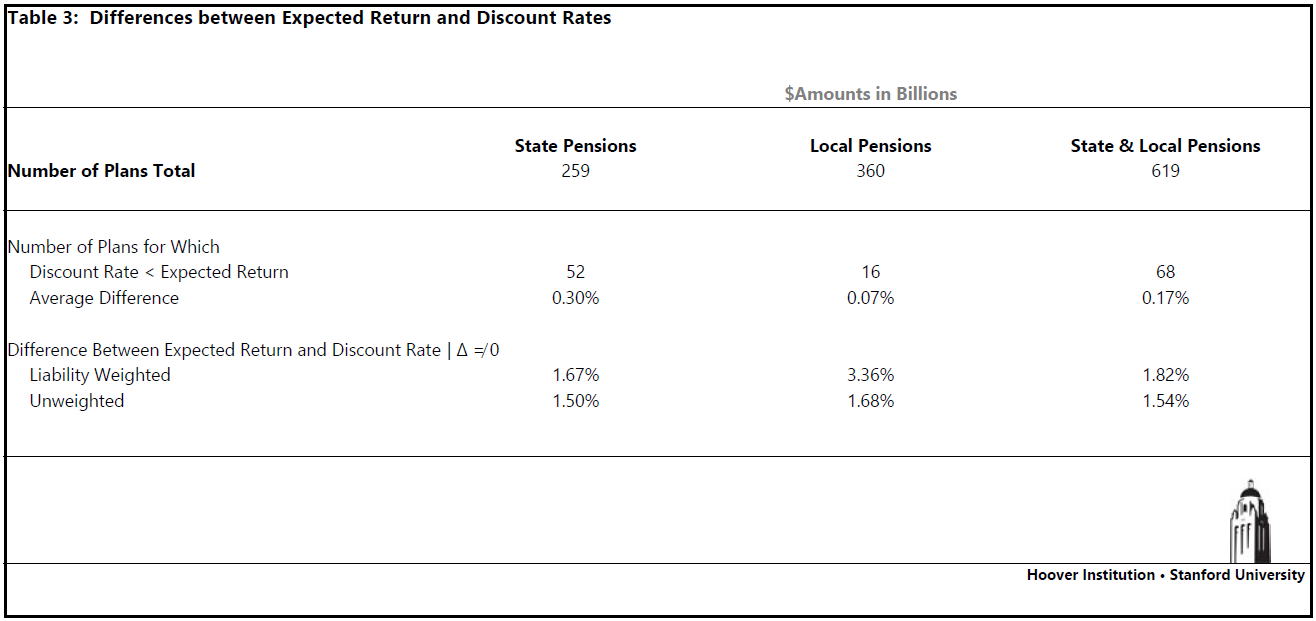

Table 3: Differences between Expected Return and Discount Rates

The first part of Table 3 provides the number of state and local pensions that have lower discount rates than expected return rates as well as the average differences. For 2017, 68 state and local pensions fell into this category, and on average they had a difference of 0.17%. In the second part of the table, data regarding the differences between expected return rates and discount rates are provided (includes both liability-weighted and unweighted rates). The average liability weighted rate differential was 1.82% and the average unweighted rate differential was 1.54%.

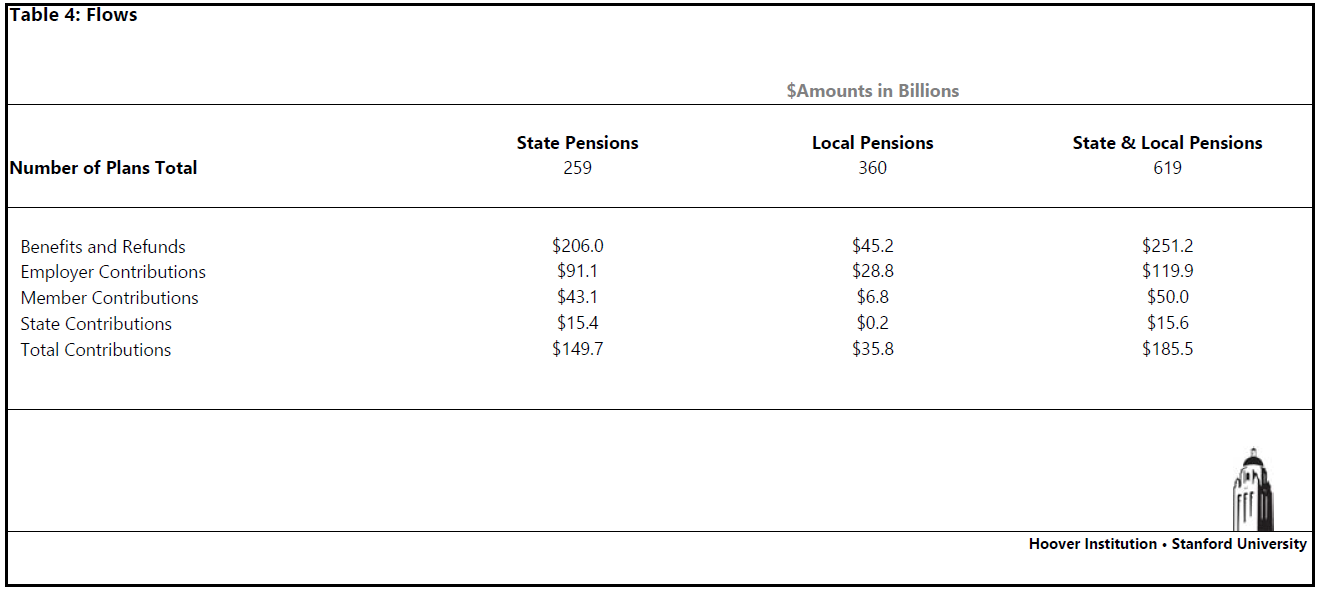

Table 4: Flows

Table 4 shows actual flows into and out of state and local pension systems. These systems paid out $251.2 billion in benefits and refunds while collecting contributions of $185.5 billion, of which $119.9 billion came from the sponsoring governments. This calculation reveals the extent to which state and local governments are relying on investment returns to pay for pension benefits.

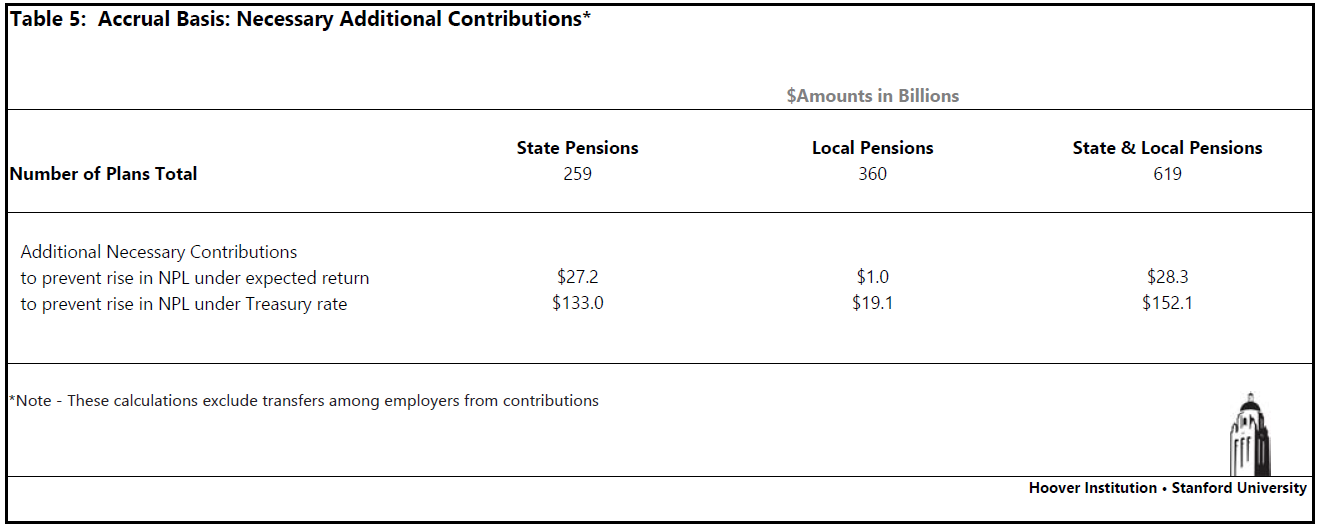

Table 5: Accrual Basis: Necessary Additional Contributions

Table 5 shows that necessary additional contributions to prevent rising unfunded liabilities are generally larger than the contributions made. Assuming that the expected return had been realized in 2017 and not less, an additional $28.3 billion would have been required. Under the market-valuation method based on Treasury returns, an additional $152.1 billion would have been required. The difference can be thought of as representing the amount by which state and local governments are depending on strong performance of risky assets to keep their unfunded obligations from growing.

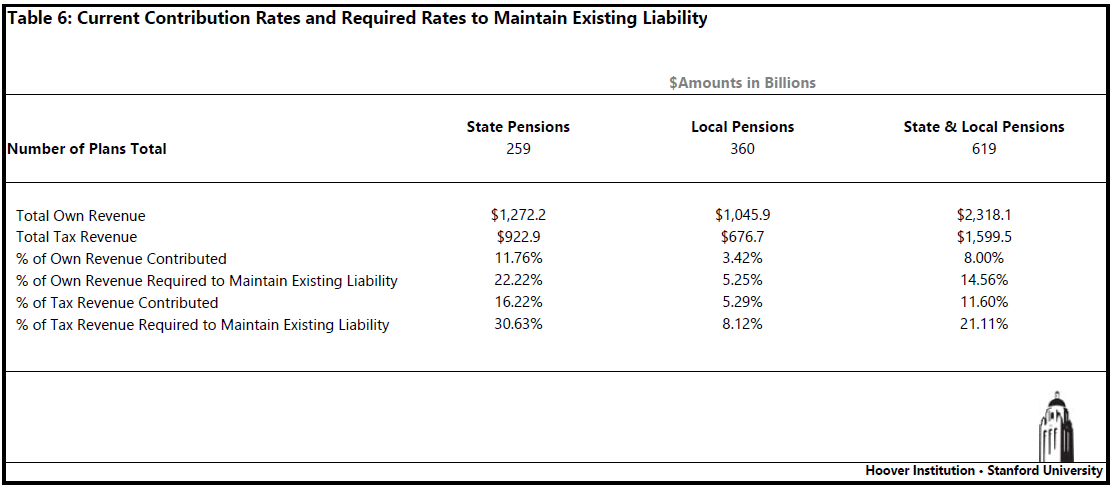

Table 6: Current Contribution Rates and Required Rates to Maintain Existing Liability

Table 6 shows the true annual cost of keeping pension liabilities from rising from an ex ante perspective. This cost is $337.6 billion (= $185.5 contributed+ $152.1 additional). This amounts to 14.56% of state and local government own revenue, including that of governments that do not themselves sponsor pension plans, before any attempt to pay down unfunded liabilities. Focusing on tax revenue, that one-year cost is equal to 21.11% of all state and local revenue that comes from taxation as opposed to fees for government services and other sources.

Figures 1 & 2: Funding Ratios by State

Figure 1 shows these funding ratios for the twenty-five states with the highest percentages in 2017, while Figure 2 shows the twenty-five states with the lowest. These statistics are for state-sponsored funds only. Market-valuation funding ratios vary widely and run from a minimum of just 29.5% in South Carolina to a maximum of 70% in South Dakota. The difference in stated funding ratios and those calculated using the risk-neutral market value approach is also often significant. For example, South Dakota’s stated funding ratio is 100%, leading one to believe that it is completley funded. However, its market value funding ratio is only 69.6%.

Figure 3: Multiple of Estimated Tax Revenues

Figure 4: Multiple of Estimated Total Own State Revenues

Figure 3 examines unfunded liabilities as multiples of estimated tax revenue at both the state and local levels. On the left side of the figure, the first graph includes all fifty states ranked by the multiples of state-only tax revenue. On the right side of the figure, the second graph also includes all fifty states; however, here they are ranked by the multiples of state and local tax revenue. Figure 4 utilizes the same bifurcation between graphs; however, instead of having the multiples estimated based upon total tax revenues, the multiples are estimated using total own state-only revenues and total own revenues on the state and local levels. Multiples of tax revenues in both graphs range extensively. For example, when focusing on the multiples of state-only tax revenue, Alaska’s is over seventeen while Vermont’s multiple is just over one. While Alaska’s extreme multiple is in part caused by the effect that petroleum price shocks had on the state’s revenue, high multiples are seen in other states as well. Illinois and South Carolina, with the second and third highest multiples respectively, both have unfunded liabilities over seven times their estimated state-only tax revenues.

Figures 5 & 6: Percentage of State Revenues Contributed

The next analysis examines the flow, or “pension deficit”—how much new unfunded liabilities are accrued each year under the different measurement techniques. Figures 5 and 6 show the share of own revenue actually contributed to pension systems in each state, as well as the share required to be contributed to avoid an increase in the unfunded liability. Figure 5 shows the twenty-five states with lowest required shares while Figure 6 shows the twenty-five states with the highest.

These figures illustrate large differences between the amounts actually contributed and the amounts necessary to contribute to avoid rises in unfunded liabilities. In many states, GASB NPL increases even under the assumption of expected return—that is, the bottom bar is larger than the top bar. In all states except Michigan, the contributions required to keep the UMVL from increasing outstrip those actually made, and in many cases substantially so.

In other states, one sees even more troubling statistics. For example, in Nevada contributions were 10.8% of own revenue in 2017. Even if Nevada had reached its assumed rate of return, the state would have had to contribute 13.9% of own revenue in order to prevent a rise in the NPL. Under the MVL approach, the pension budget would be balanced (in the sense of non-increasing debt) if Nevada had contributed 22.9% of own revenue, well over twice of what it actually contributed. None of these calculations include any amounts to pay down unfunded liabilities.

States for which the pension deficit under the UMVL measure is close to the pension deficit under the expected return measure are generally those for which the present value of newly accrued benefits is relatively small compared to the size of the interest cost, which is a function of the unfunded liability. These states fall into two categories. First, there are states that have undertaken pension reforms, which typically slow the rate of future growth rather than reduce accrued liabilities. Second, there are states where interest costs are high relative to service costs because of the large extent of unfunded liabilities.

For example, Rhode Island requires 7.4% of own revenue under the expected return measure but 9.3% of own revenue under the MVL measure, a relatively small difference. This is because Rhode Island undertook a major pension reform in 2011 that reduced benefit accruals substantially by introducing a hybrid element to its pension system. For service beyond that date, employees’ pensions would grow at a slower rate; in addition, they receive contributions to a defined contribution plan. As a result, service costs for Rhode Island are small relative to interest costs.

Connecticut and Louisiana also show a relatively small difference between the pension deficit measures, but this rather reflects the fact that the pension systems in these states have very poor funding ratios. The return on assets in these states therefore has a less important impact because there are comparatively few assets to begin with.

Figures 7 & 8: Stated and Market Value City Funding Ratios

Figure 7 shows the twenty cities with the highest funding ratios in 2017, while Figure 8 shows the twenty cities with the lowest ratios. Similarly to the states’ ratios, cities’ MVL funding ratios vary widely, from just 22.9% in Chicago to a maximum of 74.5% in Fresno, California. Large differences in stated and market value are again prevalent as well. For example, Fresno’s stated funding ratio is 112%.

Figure 9: Pension Debt as a Multiple of Own Revenue and Tax Revenue

Figure 9 shows the pension debt (NPL and UMVL) as a multiple of own revenue and tax revenue, in descending order of the latter. Among top-forty US cities by population, Chicago’s pension liabilities were the largest multiple of 2017 revenue, at 13.6 times own source revenue and 25.2 times tax revenue. Milwaukee, Omaha, Los Angeles, and Orlando are the other cities in the top five according to UMVL as a share of total own revenue, surpassing multiples of 3.7. Milwaukee, Omaha, Los Angeles, and St. Paul are the other cities in the top five according to UMVL as a share of tax revenue, surpassing mutlipes of 8.0 times total tax revenue.

Figure 10 & 11: Percentage of City Revenues Contributed

Figures 10 and 11 show the pension deficits. The City of Chicago contributed 33.2% of its own revenue to pensions in 2017; but to prevent a rise in the UMVL (that is, to run a balanced pension budget on a market-value accrual basis), it would have had to contribute a full 63.3% of its own revenue. Milwaukee, Omaha, Los Angeles, and San Francisco would all have had to contribute more than 25.3% of their budgets just to prevent the UMVL from rising.

As was the case for states, cities that have undertaken pension reforms to slow the growth of new pension benefits show smaller differences between the pension deficit under the MVL and the pension deficit under the expected return measures, as service costs will be small relative to interest costs. One example is Philadelphia, which introduced a new hybrid planand requires employees who do not elect to participate to contribute more to the plan. As a result, the city only needs to contribute 11.4% of own revenue to prevent increases in unfunded liabilities, despite the fact that its unfunded legacy liability is quite large.

Another factor that generates differences in the extent to which the UMVL pension deficit exceeds the expected-return deficit is the choice of the expected return itself. Systems that already assume a lower rate will have less distance between the measures. Some examples include the Portland, Oregon, Fire & Police Disability & Retirement Fund and the legacy systems of the city of Indianapolis, which use discount rates that are not far from Treasury rates due to their very low funding ratios. However, since the Indianapolis systems have long been closed to new workers, the pension deficits for the city overall are small relative to the city’s resources.

Figure 12: Funding Ratios by County

Figure 12 shows the top twenty-four counties’ funding ratios, ranging from a minimum of 28.6% in Miami-Dade County, Florida, to a maximum of 75.18% in Oakland County, Texas.

Figure 13: Multiples of Estimated Tax Revenues and Own County Revenues

Figure 13 shows pension debt as a multiple of own revenue and tax revenue, in descending order of the latter. Los Angeles, California, had the largest multiple, at 55.03 times own source revenue and 108.3 times tax revenue. Orange County, California, San Diego, California, and Cook County, Illinois are the three counties with the next highest multiples, and all three surpass multiples of six times total own revenue and ten times total tax revenue.

Figure 14: Percentage of County Revenues Contributed

Figure 14 shows the counties’ pension deficits. Orange County, California, contributed 34.9% of its own revenue to pensions in 2017, but under MVL it would have had to contribute 75.9% to prevent a rise in unfunded liability. Cook County, Illinois, and three counties in California—Sacramento, San Diego, and Kern—also would have had to contribute more than 40% of their own revenue budgets just to prevent the UMVL from rising.